Introduction

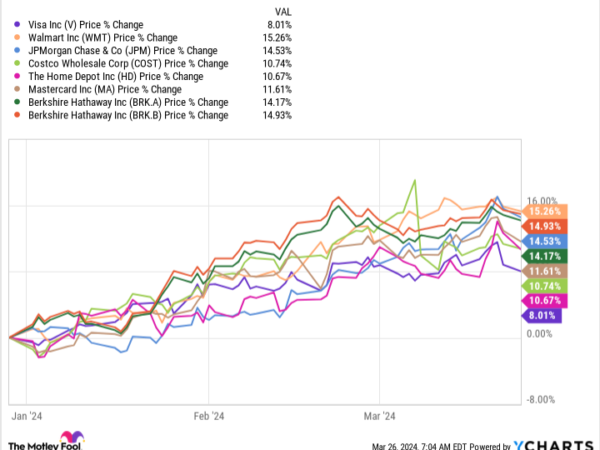

It’s almost the end of the first quarter of the calendar year, and the good news for investors is that the S&P 500 index has delivered steady gains of 9% in 2024. More importantly, the stock market seems set for more upside as the year progresses thanks to strong earnings performances from major names in the index.

Not surprisingly, analysts have been quickly raising their forecasts about where the S&P 500 could be at the end of the year. Bank of America now expects the S&P 500 to hit 5,400 by the end of 2024 as compared to its earlier forecast of 5,000. Goldman Sachs lifted its forecast to 5,200 last month from 4,700 in December, but it looks like the investment bank will have to further raise its expectations as the index is already past that mark.

This broader stock market rally is going to be a big tailwind for the likes of Nvidia (NASDAQ: NVDA), The Trade Desk (NASDAQ: TTD), and Micron Technology (NASDAQ: MU). All three companies are benefiting from a major catalyst that could help them maintain impressive levels of growth in 2024 and beyond.

Let’s look at the reasons all three stocks are likely to head higher as the year progresses.

Table of Contents

1. Nvidia

Nvidia stock has delivered impressive gains of 87% in 2024 as of this writing. And it still has the potential to deliver more gains this year thanks to its aggressive product road map that should allow it to maintain its dominance in the lucrative artificial intelligence (AI) chip market.

2. The Trade Desk

The Trade Desk stock is up 21% this year, and there is a good chance it could end 2024 with much stronger gains. The company’s growth is accelerating due to higher spending on digital advertising as well as the increasing adoption of its programmatic advertising platform.

3. Micron Technology

Shares of Micron Technology have jumped 39% this year, and the company’s latest results suggest that its bull run is just getting started. The memory specialist crushed Wall Street’s expectations in the second quarter of fiscal 2024 (for the three months ended Feb. 29) with $5.8 billion in revenue and $0.42 per share in adjusted earnings.